Root Barriers and Home Insurance: What Homeowners Should Know

As a property owner, protecting your building from potential damage is always a priority. One often overlooked yet crucial factor is the risk posed by tree roots. Installing a root barrier can prevent costly damage to foundations, plumbing, and landscaping. But did you know that root barriers can also impact home or commercial property insurance? In this guide, we’ll cover what property owners should know before installing a root barrier.

Root Barriers: Purpose and Benefits

A root barrier is a physical or chemical barrier installed in the soil to prevent tree roots from spreading into unwanted areas. Typically made from high-density polyethylene (HDPE) or other durable materials, root barriers can:

Protect foundations from root intrusion

Prevent damage to pipes, driveways, and sidewalks

Maintain landscape design and prevent unwanted tree growth

Use Case: If you have a large tree near your property line, a root barrier can prevent the roots from damaging your building’s foundation or sewer lines, saving thousands in repairs.

How Root Barriers Affect Home and Commercial Property Insurance

Tree roots may seem harmless, but they can cause serious damage to your property over time. Installing a root barrier isn’t just about preventing physical damage, it can also influence your insurance coverage, claims, and premiums. Here’s a deeper dive into what property owners should know:

1. Insurers Favor Proactive Measures

Insurance companies assess risk when setting premiums. Properties that take preventive measures, like installing root barriers, demonstrate lower risk for root-related damage. This can sometimes:

Reduce insurance premiums

Strengthen your case in the event of a claim

Show proactive maintenance, which is often required by policy terms

Example: A homeowner who installs root barriers to protect a sewer line is considered proactive, reducing the likelihood of denied claims due to negligence.

2. Understanding Policy Exclusions

Some insurance policies exclude tree root damage entirely. Key points to check:

Structural Damage Exclusion: Damage to foundations, walls or driveways caused by tree roots may not be covered.

Plumbing Damage Exclusion: Roots infiltrating sewer lines may not be included unless preventive measures were taken.

Maintenance Clauses: Policies may require regular maintenance to remain valid, including tree and landscaping management.

Tip: Review your home or commercial property insurance policy carefully. Knowing what is excluded allows you to justify preventive measures like root barrier installation.

3. Documentation and Proof

If damage occurs despite a root barrier, having proper documentation is critical:

Installation invoices and photos

Professional landscaper or arborist reports

Warranties or manufacturer specifications for the barrier

Why It Matters: Insurers are more likely to honor claims if they can see that preventive measures were in place. Documentation proves that you weren’t negligent.

4. Impact on Claims

Root barriers can influence claims in several ways:

Prevent Denials: If roots cause damage but a barrier was installed, the insurance company may recognize your proactive steps.

Accelerate Claims Processing: Clear records of preventive measures can make claims approval faster.

Minimize Out-of-Pocket Costs: Root barriers reduce the likelihood of extensive repairs that insurers might not fully cover.

Commercial Use Case: For office complexes, retail properties or parking lots root barrier documentation can be crucial in disputes over pavement or utility damage caused by trees.

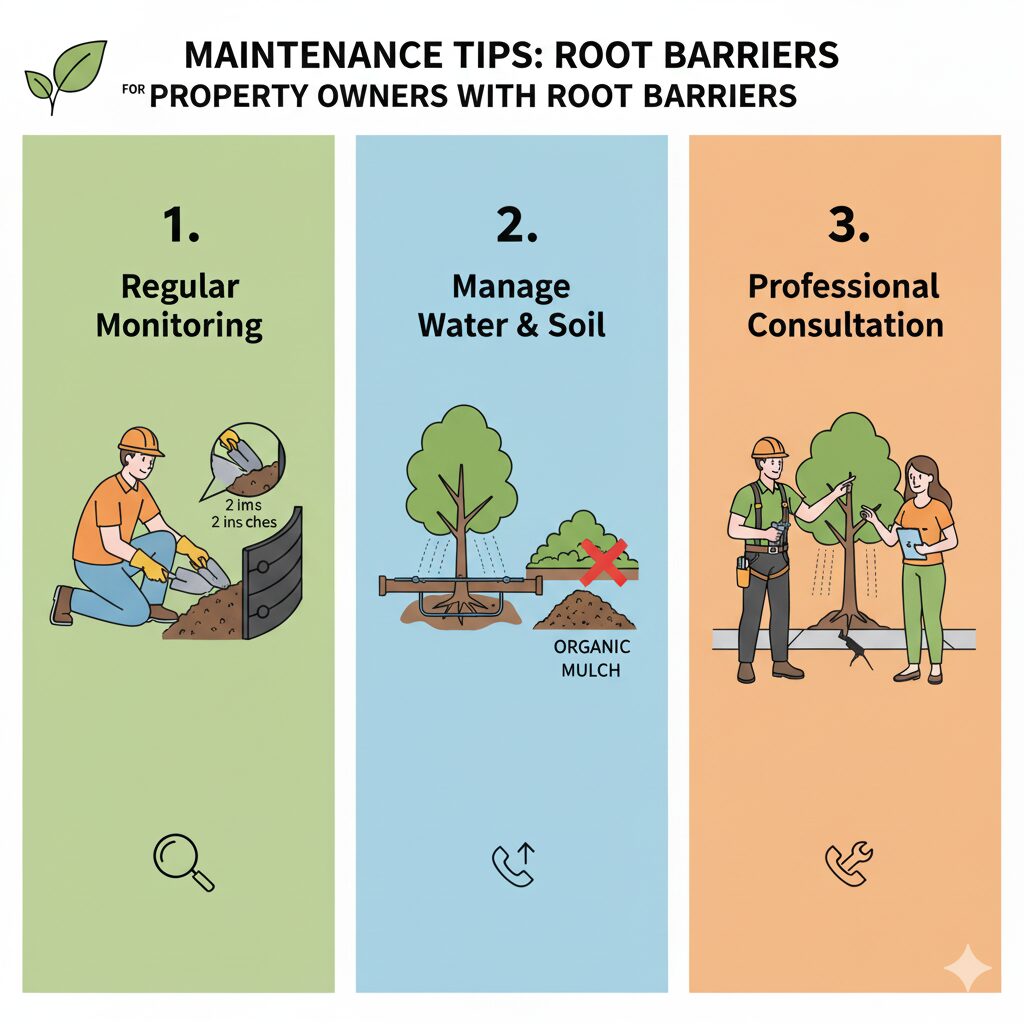

5. Combining Root Barriers With Regular Maintenance

While root barriers are effective, they don’t eliminate all risks. Insurers favor properties that combine:

Root barriers for prevention

Regular tree inspections and pruning

Monitoring of underground utilities

Prompt repair of minor damages

Tip: Maintaining a full preventative strategy strengthens your insurance position and keeps your property safe.

6. Choosing Insurers That Recognize Preventive Measures

Some insurers actively reward homeowners and commercial property owners for proactive damage prevention:

Ask if installing root barriers can impact premium rates

Check if your policy offers coverage enhancements for proactive landscaping

Ensure that preventive measures like barriers are recognized in risk assessments

Root Barriers vs. Alternative Solutions

While root barriers are highly effective, they aren’t the only way to manage tree roots. Property owners sometimes consider other options:

Tree Removal: Removing the tree completely eliminates the problem but may reduce property value and shade benefits.

Root Pruning: Cutting back roots provides temporary relief but often leads to regrowth, making it a short-term fix.

Chemical Barriers: Chemical root treatments can deter growth but may not be eco-friendly and often require re-application.

Why Root Barriers Are Better: Unlike other solutions, root barriers are a long-term, environmentally safe method that preserves the tree while protecting your property and insurance interests.

Choosing the Right Root Barrier

Not all root barriers are created equal. Here are tips for both residential and commercial properties:

Material: Use durable materials like HDPE or reinforced plastic.

Depth: Ensure the barrier goes deep enough to block roots from reaching foundations or utilities.

Professional Installation: Improper installation can render the barrier ineffective, which can complicate insurance claims.

Use Case: A commercial property with multiple trees may require a professional assessment to determine barrier placement, depth, and materials to prevent foundation or pavement damage.

How to Talk to Your Insurance Provider About Root Barriers

Many homeowners and business owners don’t realize they can (and should) discuss preventive landscaping with their insurer. Here’s how:

Ask About Coverage: Find out if your current policy covers root-related damage.

Show Documentation: Provide installation receipts, photos, and arborist reports to demonstrate preventive measures.

Inquire About Discounts: Some insurers reward property owners who take risk-reduction steps.

Update Policy Records: Ensure your insurer has updated notes that you’ve installed a root barrier, which may help in future claims.

Pro Tip: Having a conversation with your insurer before installing a root barrier can clarify what type of damage will or won’t be covered, helping you make an informed decision.

Additional Tips for Property Owners

Inspect Trees Regularly: Even with a root barrier, monitor tree growth to prevent unforeseen damage.

Check Local Regulations: Some municipalities have guidelines for root barrier installation near property lines.

Integrate With Landscaping: Root barriers can protect property while maintaining aesthetic landscaping for both homes and commercial spaces.

Final Thoughts

Installing a root barrier is a smart move for any property owner, residential or commercial. Not only does it protect foundations, plumbing, and landscaping, but it can also influence insurance coverage and claims. By choosing the right barrier, documenting installation and staying proactive, property owners can prevent expensive repairs and maintain peace of mind.

Serving Houston, Texas, Richmond, Clear Lake , Katy , Friendswood and Pearland , our team is here to help you protect your property. Visit foundationrepair.com or call us today at 📞 281-420-1739 to schedule your consultation with our root barrier and foundation repair experts.